During a purchasing decision, the organization may prepare some estimates of the full life cycle costs to compare projects. Once the asset is purchased, however, the tracking of other actual expenses, such as maintenance, falls by the wayside. Those in the finance department tend to focus primarily on what information is needed for financial reporting, e.g., asset costs and depreciation.

Innovations in Fixed Asset Management

Physical tracking of assets refers to the process of tracking and monitoring assets that allows for real-time visibility, ensuring assets are in the right location and condition. This process is vital for maintaining accurate records, preventing loss, and optimizing asset usage. A well-maintained Fixed Asset Register (FAR) serves as the cornerstone of this process. By consistently updating the asset register, businesses ensure their assets are properly tracked throughout their lifecycle.

- Additionally, you have the choice of when to sell an asset, which might free up funds for fresh investments.

- Managers can better predict the length of an asset’s useful life, providing better forecasting of future replacement needs or major service expenditures.

- A fixed asset is a tangible, long-term asset held by a company for use in its day-to-day operations and not intended for sale.

- The determination of useful life significantly impacts a company’s depreciation expense, playing a crucial role in shaping financial statements and influencing profitability.

Overview of Asset Lifecycle Management

The straight-line formula, dividing the asset’s initial cost by its estimated lifespan, is a common method. Factors such as wear and tear, technological advancements, industry standards, and maintenance practices all contribute to the determination of useful life. Tractor units and specific horses fall under the category of 3-Year Property, referring to assets with a recovery period of three years for tax purposes. These assets are subject to accelerated depreciation methods, allowing businesses to claim deductions over a shorter period. The Fixed Asset Useful Life Table plays a crucial role in tracking and managing the depreciation of such assets, providing a structured framework for tax reporting and optimizing financial planning. Financial reporting and tax implications are intricately linked to the understanding and application of fixed asset useful life.

- However, there is no specific ratio or range that defines a “good” asset turnover ratio.

- LCC considers all costs related to keeping a fixed asset in production throughout the asset’s entire life cycle in order to optimize both the initial investment and the continuing costs of repairs and maintenance.

- Fixed Asset Lifecycle Management refers to the process of managing assets from acquisition through to disposal.

- Having a detailed understanding of these factors empowers companies to allocate resources more effectively, avoiding overutilization or underutilization of assets and ultimately driving operational efficiency.

- Fixed asset management is an essential practice that ensures optimal utilization and accurate valuation of a company’s assets.

Asset Disposal

You also need to rely on the right life cycle asset management technology to keep productivity high and errors low. Asset tracking software like RedBeam can help you monitor all of your assets in real-time throughout their entire lifecycle. Regularly review and update your fixed asset management policies to reflect changes in business operations, technology, and regulations. Staying current with industry standards and best practices ensures that your asset management practices remain effective and compliant. Maintain detailed records of all asset lifecycle events, including acquisition, maintenance, and disposal. This documentation supports transparency and accountability, making it easier to track asset performance and compliance with regulatory requirements.

This is the second most important part of asset lifecycle management, next to the planning stage. While your planning stage sets the trajectory for your overall asset health, your maintenance is what determines how long each asset will actually live. Expenses are typically costs that are incurred and consumed within the same accounting period, such as utilities or office supplies.

You can also use standard accounting, operational,and registry reports for ease of reconciliation and analysis. It should be noted, however, that CMMS and EAM software are often used together to get the full benefit of both systems. Organizations may use one or a combination of these strategies to keep assets in proper working order. For detailed guidelines and examples specific to your industry or asset type, consulting the Financial Accounting Standards Board (FASB) Codification or seeking advice from accounting professionals is recommended. Additionally, you have the choice of when to sell an asset, which might free up funds for fresh investments.

Strategic Decision-Making

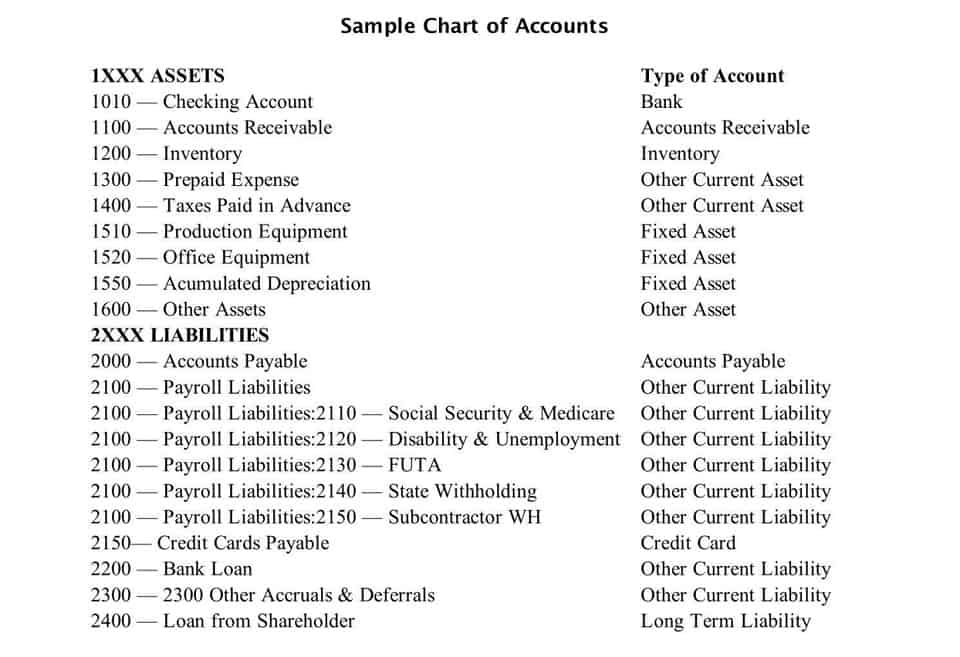

Tools like this can help perform a variety of tasks, like recording financial transactions, managing inventory, paying taxes, or generating financial statements. Fixed asset accounting is about keeping up-to-date records of the business’s diverse capital assets and their respective values. However, you don’t just write down the purchase price—you need to account for all the fixed asset accounting costs incurred to place the asset in service, including shipping, installation, training, insurance, and taxes. Here, you need to plan what assets your business requires, after evaluating the condition of the assets you have at present. Assets can fail or get damaged if not cared for and maintained properly – which makes maintenance an important part of asset management.

- In manufacturing, machinery and equipment may undergo rigorous use, leading to a shorter useful life, especially if subjected to high levels of wear and tear.

- By aligning operational goals with the anticipated lifespan of assets, businesses can optimize resource allocation, prevent unexpected disruptions, and minimize the risk of unforeseen expenses.

- And that effective management of fixed assets throughout their lifecycle is what we call fixed asset management.

- By implementing an asset management system, you can effortlessly track and monitor your fixed assets, oversee equipment and machinery in various locations, reduce maintenance costs, and boost operational efficiency.

- It involves managing a wide range of assets, from machinery and equipment to IT systems.

Depreciation and Revaluation

- Many assets have increased operational and maintenance costs as they near the end of their useful life.

- As time goes on, the maintenance team must be mindful of how maintenance needs will change over time.

- Fixed asset management helps businesses comply with various accounting and taxation regulations.

- Whether you’re just getting started or ready to take your asset tracking to the next level with asset and equipment management software, we have the perfect resources for you.

- This difference makes the organization an ideal candidate to study the concept of life cycle costing (LCC).

- Effective fixed asset management enhances financial accuracy by ensuring that assets are correctly valued in financial statements.